Signs of a Private Quantum Investment Slowdown in First Half of 2023

Insider Brief

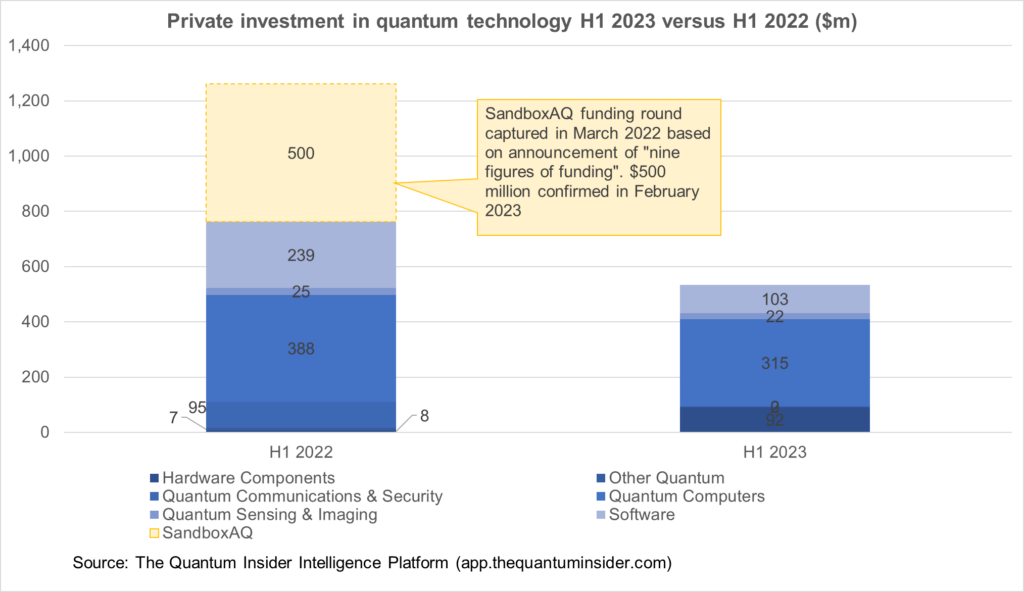

- Data from The Quantum Insider Intelligence Platform show funding rounds in the quantum industry are slowing in the first half of 2023 compared to the same time last year.

- Investing in quantum computing has held steady.

- Analysts don’t rule out year-to-year statistical aberrations and point toward other positive signs, including suggestions of new deals in the pipeline and improving economic conditions.

The pace of commercial investment in quantum has taken a dip in the first half of 2023 compared to a similar time frame of 2022, according to statistics from The Quantum Insider Intelligence Platform.

By the end of June in 2022, the total investment of funding rounds in quantum was set at approximately $1.3 billion. Currently, the total for Quarter 1 and Quarter 2 of 2023 was around $0.6 billion, or very close to half the 2022 numbers.

Investments in quantum software have dropped off noticeably however makers of quantum computers brought in $315 million in the first two quarters of 2022, nearly matching last year’s $329 million investment level.

Is There a Problem in Quantum Investing?

Before we hit the panic button, several reasons may explain the drop off in investments.

First, funding rounds rarely pace in a linear fashion and they certainly don’t adhere to arbitrary financial timelines. They tend to hit in clumps. It may not be fair, therefore, to compare two random quarters of one year with a similar stretch of another year, nor does that lend itself to accurately predicting the remainder of the year.

The way that information on funding rounds hits the market does not adhere to arbitrary timescales — like annual or quarterly figures — either. A good recent example is Sandbox AQ’s half-billion funding round, which was captured in our market intelligence when it was announced in late 2022. However, it was confirmed more broadly in early 2023. That $500 million would have significantly tightened the difference between 2022 and 2023 numbers had it been included in 2023’s Q1 figures.

It’s also possible that the strong funding environment in 2021 and 2022 gave quantum companies enough runway for operations beyond 2023. Because quantum is a relatively small — but rapidly emerging — niche, there may have been few new companies seeking funds. Nonetheless, our analysts understand that many quantum companies are actively raising financing, or at least preparing to.

We should not rule out macroeconomic trends. In 2022, the tech field was hit hard by the resumption of the post-pandemic economy. Rising inflation and soaring interest rates also took their tool on the economy. Overall VC investment in the US dropped from $81 billion in Q1 2022 to $44 billion in Q1 2023. Most experts were surprised that the nascent quantum industry wasn’t hit harder. It could be that these macroeconomic winds finally hit the quantum market.

Finally, several quantum companies — now under the spotlight as public companies — have sputtered. The implosion of the Special Purpose Acquisition Company market — relied on by several quantum startup leaders to take their firms public — may skew the comparisons. The shuffling of top quantum company brass and news of emergency loans may have created skittishness around quantum investing, as well.

More Positive Signs

While this early forecast on quantum investment should create some concern, there are signs that the industry could get back on pace. For instance, policymakers have been aggressive in advocating for and funding quantum initiatives. Germany announced a €3 billion — or about $3 billion US — program for a universal quantum computer, The UK has been particularly active with a £2.5 billion quantum initiative and a billion-pound program for semiconductor (some of which would go to quantum). Scandinavian continues to be a global leader in quantum with several projects, including the Danish government’s billion-kroner quantum investment and the Netherlands’ €15 million fund to bolster quantum startups.

This government money should eventually work itself into those nation’s respective quantum ecosystems, inspiring new companies and university spin-outs, encouraging startups to seek additional funding and likely pushing already funded quantum companies into advanced funding rounds.

Other positive signs include the shoring up of the stock market and indications that several central banks are leaning toward loosening interest rate hikes.

While not official, The Quantum Insider analysts are tracking dozens of quantum companies that are looking to raise money and are exploring merger and acquisition options. This could lead to a robust end to 2023 and may even out some of the Q1 and Q2 doldrums.

The Quantum Insider will be releasing its Q2 report soon, which will explore the quarterly results in detail.