SEC Filings Point to $10.8 Million in Funding For Infleqtion

Insider Brief

- Recent filings indicate Infleqtion is embarking on a new funding round.

- Two Form D filings with the U.S. Securities and Exchange Commission (SEC) show Infleqtion raised approximately $10.8 million from investors.

- Form D is a brief notice companies must file with the SEC when they raise capital from investors through exempt offerings.

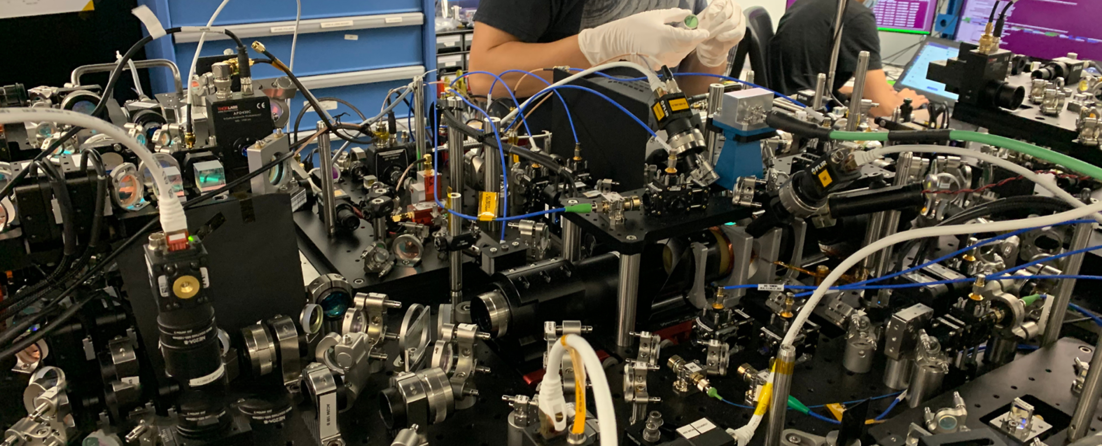

- Image: Infleqtion

In a significant move for the quantum technology sector, Infleqtion, a prominent quantum information company, has raised approximately $10.8 million from investors, according to recent filings with the government and a recent BizWest article.

This funding round, disclosed through two Form D filings with the U.S. Securities and Exchange Commission (SEC), represents a significant step the company as it seeks to advance its quantum technology initiatives. The fundraiser comes on the heels of Matthew Kinsella’s appointment as CEO, perhaps a signal to the company’s strategic direction under new leadership.

Form D is a brief notice companies must file with the SEC when they raise capital from investors through exempt offerings, which are not registered with the SEC. These filings provide transparency about the fundraising activities of companies, offering details such as the amount raised and the type of securities sold.

For Infleqtion, the recent filings suggest investor confidence in the company and, broadly, a sign of growing optimism in a growing momentum among companies competing in the quantum technology landscape.

It’s an optimism expressed by Kinsella when he took the helm in April, expressed optimism about the company’s trajectory, saying: “Infleqtion is well positioned to lead as quantum technology shifts out of the lab and into the commercial realm. I’m honored to guide the company through our next pivotal phase. With our robust foundation, exceptional team, and dedication to scalable solutions, we are ready to seize the immense potential of quantum technology to revolutionize industries and create a brighter future for all. Our focus on clocks, RF, compute, and quantum-enabled AI software presents growing and near-term revenue opportunities. We are committed to developing and delivering cutting-edge solutions to our customers.”

Infleqtion’s focus areas include advanced clocks, radio frequency (RF) technology, computing, and quantum-enabled artificial intelligence (AI) software. These domains represent significant growth opportunities with near-term revenue potential, aligning with the company’s mission to deliver cutting-edge solutions to its customers.

Quantum technology is widely viewed as a transformative force across various sectors, including finance, defense, energy, healthcare, and life sciences. Infleqtion’s strategic partnerships underscore this potential. The company has signed agreements with Japan’s Quantum Moonshot program, the National Quantum Computing Centre in the United Kingdom, and the Defence Cyber Marvel 3, Europe’s premier cyber defense exercise organized by the Army Cyber Association.

Infleqtion: Quantum Pioneer With an Expanding Network

According to The Quantum Insider Intelligence Platform, Infleqtion boasts an impressive network: 10 enterprise users, 43 organizations, 2 universities, 6 centers, 2 governments, and 10 investors. The company is both entrenched in the Colorado quantum ecosystem, as well as a member of the Chicago Quantum Exchange, which are two growing quantum communities in the US.

One of Infleqtion’s most ambitious projects is its 5-year quantum computing program, Sqorpius, as revealed in a roadmap released in February of this year. The program features a groundbreaking 1600-qubit array and aims to achieve significant milestones by 2028, including the development of fault-tolerant quantum computers. The company sees this program as eventually delivering substantial commercial benefits and represent critical steps toward realizing scalable quantum computing solutions.

Infleqtion, formerly known as ColdQuanta, also develops instruments, components and systems for various quantum applications, from cold atom experimentation to quantum information processing and inertial sensing. Notably, Infleqtion acquired the Chicago-based cloud quantum computing company Super.Tech in May 2022, enhancing its capabilities in cloud-based quantum computing.

The company has also launched several innovative products, including the miniMOT V2, a next-generation compact vacuum system for neutral atom research, and Tiqker, a commercial atomic clock designed for precise timing in GPS-denied environments. Infleqtion’s flagship quantum software platform, Superstaq, is offers enhanced computational power and improved error messaging for quantum application developers.

Part of a Larger Funding Round?

While it’s not possible to predict exactly how Infleqtion’s funding round will progress, filing a Form D with the SEC indicates that a company is raising capital through an exempt offering, but that doesn’t necessarily mean that the disclosed amount is the only money it will raise in that funding round. In fact, companies often file Form D early in the fundraising process and may update the filing as they raise additional funds. This means that the $10.8 million Infleqtion has raised so far could be part of a larger fundraising effort.

The Form D filing provides details on the initial amount raised, the total amount the company plans to raise and other pertinent information about the offering. If Infleqtion is targeting a higher total raise, subsequent filings or amendments to the existing Form D could reveal additional capital raised as the round progresses.

It’s not uncommon for companies to announce further investments or additional funding rounds after the initial filing, especially if they continue to attract interest from investors. If that’s the case, the $10.8 million disclosed by Infleqtion might just be the beginning of a larger funding strategy.