IonQ Opens Door to Dramatically More Powerful Quantum Computers, Debuts Industry First: Reconfigurable Multicore Quantum Architecture.

- Ahead of technical roadmap expectations at the start of 2021, IonQ debuts a 4X16 Reconfigurable Multicore Quantum Architecture (RMQA) that overcomes stability challenges inherent to larger quantum computers, opening the door to quantum computers with hundreds of qubits on one chip

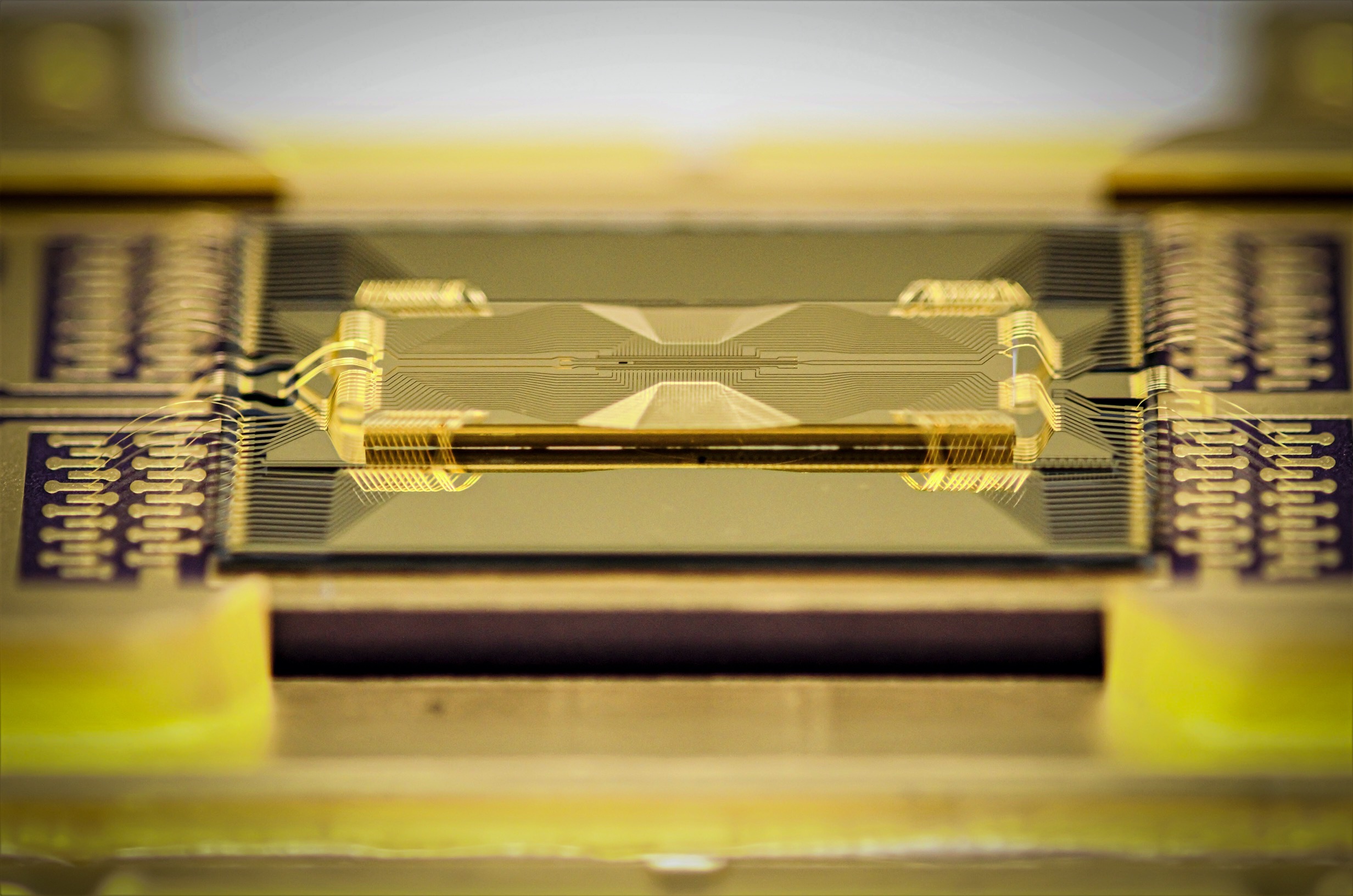

- Underpinning the technology is a new series of IonQ-developed, patent-pending EGT Series ion trap chip that unlocks: tighter ion confinement, improved ion lifetime, and reduced ion heating

IonQ, Inc. (“IonQ”), the leader in quantum computing, today unveiled the industry’s first Reconfigurable Multicore Quantum Architecture (RMQA) technology, a breakthrough in quantum computing. Starting with the demonstration of 4 chains of 16 ions each that can be dynamically configured into quantum computing cores, IonQ believes it has laid the foundation for increases to qubit count into the triple digits on a single chip, as well as future Parallel Multicore Quantum Processing Units.

This demonstration was achieved on a technological platform recently added to IonQ’s intellectual property warchest, called Evaporated Glass Traps (EGTs). Developed by an IonQ team led by UC Berkeley Physics PhD and ex-GTRI and -NIST researcher Jason Amini, the EGT platform offers an unprecedented level of performance and is a crucial part of IonQ’s roadmap to rapid scalability and increased computing power.

“The Reconfigurable Multicore Quantum Architecture marks a key milestone for IonQ and for the quantum computing industry in general,” remarked IonQ President and CEO Peter Chapman. “RMQA is a critical enabler of our ability to scale qubit density and deliver the computational power projected in our roadmap. We’re very proud of the team at IonQ that has achieved a powerful platform for scalability and control in a single technical breakthrough.”

https://www.youtube.com/embed/yvzU748e0V4

Click the player above to watch the video demonstration

IonQ’s EGT Series Ion Trap Chip, CREDIT: WALKER STEERE | IONQ

click the photo above to download a high-resolution version

Today’s news involves the separation and merger of a total of 64 ions to create a RMQA using 4 chains of 16 ions each. The ion chains are transported and merged into permutations of a higher-connectivity, 32-ion quantum computing core, allowing for scaling to large numbers of qubits without the fidelity loss that historically accompanies very long chains of ions. This architecture was realized on IonQ’s EGT Series ion trap chip, which provides the stability necessary to operate this architecture with little to no recalibration, maximizing uptime and optimizing transport. The EGT series platforms are expected to be extended to support more chains, with each chain increasing the quantum computational power by a factor of 4000 or more.

The news continues a year of considerable momentum for IonQ. Its trapped-ion quantum computers were recently added to Google Cloud Marketplace, making IonQ the only supplier whose quantum computers are available via all of the major cloud providers. In addition, IonQ’s two co-founders, Jungsang Kim and Chris Monroe, joinedthe White House’s National Quantum Initiative Advisory Committee to accelerate the development of the national strategic technological imperative. IonQ is also preparing to become the first publicly-traded, pure-play quantum computing company via a merger with dMY Technology Group, Inc. III (NYSE: DMYI) (“dMY III”).

About IonQ

IonQ, Inc. is the leader in quantum computing, with a proven track record of innovation and deployment. IonQ’s 32-qubit quantum computer is the world’s most powerful trapped-ion quantum computer, and IonQ has defined what it believes is the best path forward to scale. IonQ is the only company with its quantum systems available through the cloud on Amazon Braket, Microsoft Azure, and Google Cloud, as well as through direct API access. IonQ was founded in 2015 by Christopher Monroe and Jungsang Kim based on 25 years of pioneering research. To learn more, visit www.ionq.com.

About dMY Technology Group, Inc. III

dMY III is a special purpose acquisition company founded by Harry L. You and Niccolo de Masi for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses or assets.

Important Information About the Merger and Where to Find It

This communication may be deemed solicitation material in respect of the proposed business combination between dMY III and IonQ (the “Business Combination”). The Business Combination has been submitted to the stockholders of dMY III and IonQ for their approval. In connection with the vote of dMY’s stockholders, dMY III Technology Group, Inc. III has filed relevant materials with the SEC, including a registration statement on Form S-4, which includes a proxy statement/prospectus. This communication does not contain all the information that should be considered concerning the proposed Business Combination and the other matters to be voted upon at the annual meeting and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. dMY III’s stockholders and other interested parties are urged to read the preliminary proxy statement, the amendments thereto, the definitive proxy statement and any other relevant documents that are filed or furnished or will be filed or will be furnished with the SEC carefully and in their entirety in connection with dMY III’s solicitation of proxies for the special meeting to be held to approve the Business Combination and other related matters, as these materials will contain important information about IonQ and dMY III and the proposed Business Combination. Promptly after the registration statement is declared effective by the SEC, dMY will mail the definitive proxy statement/prospectus and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction. Such stockholders are also be able to obtain copies of these materials, without charge, once available, at the SEC’s website at http://www.sec.gov, at the Company’s website at https://www.dmytechnology.com/or by written request to dMY Technology Group, Inc. III, 11100 Santa Monica Blvd., Suite 2000, Los Angeles, CA 90025.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be made directly in this communication. Some of the forward-looking statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions are intended to identify forward-looking statements. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of dMY’s securities; (ii) the risk that the transaction may not be completed by dMY’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by dMY; (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval of the merger agreement by the stockholders of dMY, the satisfaction of the minimum trust account amount following any redemptions by dMY’s public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the lack of a third-party valuation in determining whether or not to pursue the proposed transaction; (v) the inability to complete the PIPE transaction; (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (vii) the effect of the announcement or pendency of the transaction on IonQ’s business relationships, operating results and business generally; (viii) risks that the proposed transaction disrupts current plans and operations of IonQ; (ix) the outcome of any legal proceedings that may be instituted against IonQ or against dMY related to the merger agreement or the proposed transaction; (x) the ability to maintain the listing of dMY’s securities on a national securities exchange; (xi) changes in the competitive industries in which IonQ operates, variations in operating performance across competitors, changes in laws and regulations affecting IonQ’s business and changes in the combined capital structure; (xii) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (xiii) the risk of downturns in the market and the technology industry including, but not limited to, as a result of the COVID-19 pandemic; and (xiv) costs related to the transaction and the failure to realize anticipated benefits of the transaction or to realize estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-4 and other documents filed by dMY from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and dMY and IonQ assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither dMY nor IonQ gives any assurance that either dMY or IonQ, or the combined company, will achieve its expectations.

No Offer or Solicitation

This communication is for informational purposes only and does not constitute an offer or invitation for the sale or purchase of securities, assets or the business described herein or a commitment to the Company or the IonQ with respect to any of the foregoing, and this communication shall not form the basis of any contract, nor is it a solicitation of any vote, consent, or approval in any jurisdiction pursuant to or in connection with the Business Combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in Solicitation

dMY III and IonQ, and their respective directors and executive officers, may be deemed participants in the solicitation of proxies of dMY III’s stockholders in respect of the Business Combination. Information about the directors and executive officers of dMY III is set forth in the Company’s Form dMY III’s filings with the SEC. Information about the directors and executive officers of IonQ and more detailed information regarding the identity of all potential participants, and their direct and indirect interests by security holdings or otherwise, are set forth in the definitive proxy statement/prospectus for the Business Combination. Additional information regarding the identity of all potential participants in the solicitation of proxies to dMY III’s stockholders in connection with the proposed Business Combination and other matters to be voted upon at the special meeting, and their direct and indirect interests, by security holdings or otherwise, are included in the definitive proxy statement/prospectus.

Contacts

IonQ Investor Contact:

Michael Bowen and Ryan Gardella

IonQIR@icrinc.com

IonQ Media contact:

Mission North

ionq@missionnorth.com

dMY III Investor Contact:

Niccolo de Masi

dMY Technology Group, Inc. III

niccolo@dmytechnology.com

310-600-6667

dMY III Media Contact:

ICR Inc.

dmypr@icrinc.com

The post IonQ Opens Door to Dramatically More Powerful Quantum Computers, Debuts Industry First: Reconfigurable Multicore Quantum Architecture. appeared first on Swiss Quantum Hub.